I’ve been reading the Bogleheads forum lately. For those not in the know, it is an outstanding personal finance and investment web site based on advice from Jack Bogle. One thing that caught my eye is that most military personnel are using a certain trio of banks once they grow beyond basic checking and saving account requirements. I realized I have done the same.

Where USAA Shines – Banking and Insurance

I joined USAA in 2003 and was impressed with their outstanding customer service. Their checking and savings accounts are free. The ATM rebates are nice. Their customer service when dealing with insurance claims is amazing. I still have USAA today for checking/savings/insurance.

As I added accounts, my first hunch was to always go with USAA. Over time, I realized that is a mistake. I first learned that when shopping for a mortgage for my first home. Other banks were easily beating the rates quoted by USAA.

Shop Around for Home/Auto Loans

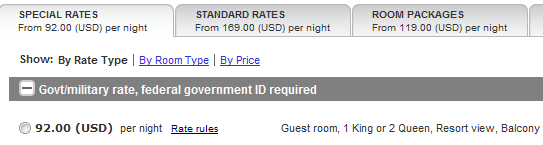

When it comes to home mortgages and auto loans, you really need to check Navy Federal and Pentagon Federal Credit Union. Their rates almost always beat USAA. These banks have very good reputations and quality customer service. One thing to keep in mine is the ‘customer service’ aspect is not as important when it comes to loans. Once the deal is done, you pay it back at the agreed upon rate.

Use Vanguard for Investments Beyond TSP

One thing you will learn on Bogleheads is to avoid USAA for investments. Of course, you should always max out TSP first. But if for some reason you are looking outside TSP (like me with my wife’s retirement fund), then you want to look at Vanguard. Why? USAA’s mutual funds have high expense ratios.

For example, the USAA First Start Growth Fund has an expense ratio of 1.44%. The Vanguard Retirement Target 2050 fund has an expense ratio of 0.16%! USAA takes much more of your money to run their investment fund as compared to Vanguard. That is money that will slow down your returns over the long haul, likely taking thousands out of your retirement fund.

I will not dive into returns in this post, but overall Vanguard has a sterling reputation as compared to other mutual funds when it comes to performance.

You can read more about why expense ratio is important here.

No. No you should not sign up for Military STAR card, ever.

No. No you should not sign up for Military STAR card, ever.

A huge part of leadership is learning to deal with people. I can’t think of a better way to learn this skill then by reading How to Win Friends.

A huge part of leadership is learning to deal with people. I can’t think of a better way to learn this skill then by reading How to Win Friends. This is a great all around book on improving yourself. If you want to get promoted at work, just try implementing the first seven habits:

This is a great all around book on improving yourself. If you want to get promoted at work, just try implementing the first seven habits: Body for Life is a great book that will help you get in shape. It not olny covers fitness, but also eating healthy. The

Body for Life is a great book that will help you get in shape. It not olny covers fitness, but also eating healthy. The