This is a guide to the benefits you receive during your first 60 days on island.

Have a question? Ask the Facebook Group.

The Good News: You Make Good Money While House Hunting

Here’s a little secret about benefits while house hunting in Hawaii:

- Hotel cost is reimbursed for a maximum of 60 days

- Per diem covers meals for up to 60 days

- Cost of living allowance (COLA) starts when you arrive

- Full housing (BAH) entitlement starts as soon as you arrive

You get all of these benefits at the same time. Since you live in a hotel while house hunting, your BAH is pure extra cash that you can use to help you get started on the island. Add in any per diem you save back while house hunting, plus COLA, and it’s reasonable to make an extra $1,400 every 10 days while looking for a home.

It’s surprising that TLA, COLA, and BAH are paid at the same time, but it is perfectly legal. I’ll cover each of these allowances in detail below.

Side note: If you are moving to Hawaii you should check out the Amex Platinum card which offers free access to airport lounges, hotel upgrades, and many other travel benefits, but the annual $550 fee is waived for military. See my post on it here!

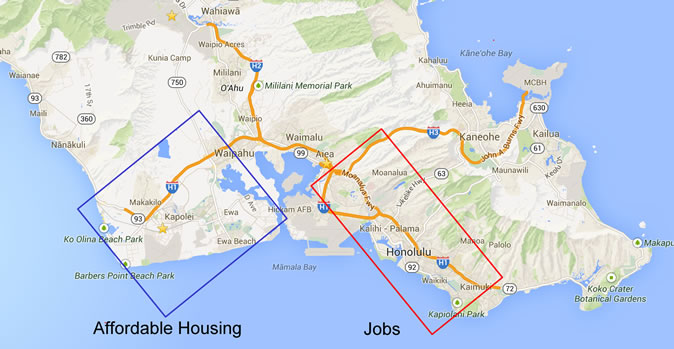

The Bad News: You May Need the Extra Money

The only “bad” news is that may need that extra money if you decide to live off base. Let’s say you rent a home for $2,500 a month. Your landlord will likely require one month’s deposit, plus first month’s rent up front.

So within 30 days of arriving on island you may have to pay $5,000 to move into your house!

That’s a big expense. We personally used the extra money to pay back the cost of shipping our second car from South Carolina, as we had already saved up for a security deposit. The military only pays to ship one car to Hawaii, unless you are a dual military couple.

Temporary Lodging Allowance (TLA) Explained

TLA is an OCONUS allowance provided to offset “more than normal” expenses while searching for a home. It is provided in 10-day increments and is based on number of dependents and current per diem rates.

Check in with your base housing office to start TLA. They provide a checklist to track homes you look at while house hunting. To continue receiving TLA, you need to show you are actively looking for a home on or off base.

TLA Formula

1. Determine your TLA percentage using the table below

| Number Occupying Temporary Lodging | Percentage Applicable |

| Member only or 1 dependent only | 65% |

| Member and 1 dependent, or 2 dependents only | 100% |

| For each additional dependent over age 12, add | 35% |

| For each additional dependent under age 12, add | 25% |

2. Multiply that percentage by the local per diem rate. For 2017 it is:

| Locality | Max Lodging | Local Meals | Proportional Meals | Local Incidental | Maximum Per Diem | Effective Date |

| HONOLULU | 177 | 98 | 56 (ignore for TLA) | 25 | 300 | 1/01/2017 |

Current per diem rates: http://www.defensetravel.dod.mil/site/perdiemCalc.cfm

Example TLA Calculation

If you are married and have two children under age 12, your total percentage is 150%. So you would receive:

$265.50 per day for lodging (177 * 150%)

$184.50 per day per diem (123 * 150%)

When calculating per diem use Local Meals + Local Incidental.

Of course you will only be paid actual lodging costs. So in this case, $265.50 is the max.

Note: If your assigned quarters contain facilities for preparing meals (e.g. small kitchen with a stove), your per diem (not lodging) is reduced by 50%. Something to keep in mind!

When Does TLA End?

Base Housing: If you are assigned base housing but cannot move in for three weeks, then your TLA will continue until base housing is available.

Renting a Home: Once you have the keys to your home then TLA ends. If you sign a lease, but the home is not available for 10 more days due to cleaning or old tenants moving out, then your TLA will continue until you can actually move in.

Purchase a Home: If you purchase a home you can use TLA until you get the keys and move in. So if you purchase a new home and it is not available for three weeks, you should receive TLA until it is available.

Not actively searching: If the housing office feels you are not actively searching for a home, then they can terminate your TLA. You need to show you are looking at reasonable homes. The maximum available time to search for a home is 60 days. I’ve heard that some housing offices complain as you approach the 60 day mark.

Assigned to Barracks: If you are assigned to on-base barracks you may not receive TLA at all if quarters are available when you show up.

Should you stay on or off base while house hunting?

Most military will need a base lodging non-availability letter to seek a hotel off base. I would definitely stay off base if it is an option. You can’t beat getting paid to stay on the beach at a hotel such as the Hale Koa or Hilton Hawaiian Village.

However, there are a few drawbacks to staying off base. High food costs at the hotels in Waikiki will eat into your per diem. In addition, parking could cost you around $18 to $30 per night! You will not be reimbursed for parking; it will come out of your per diem. Finally, driving in and out of Waikiki is a pain and can add a lot of time on the road while looking for a home, or driving to your workplace once you report in.

Cost of Living Allowance (COLA)

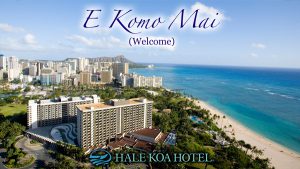

COLA is an entitlement while stationed in Hawaii to help offset the high cost of living. It ranges from about $500 – $1,500 a month and is determined by rank, time in service, number of dependents, and whether you are assigned to barracks. Overseas COLA (which includes Hawaii) is NOT taxed.

Enter your options into the overseas COLA calculator to see your allowance: http://www.defensetravel.dod.mil/site/colaCalc.cfm

The example screenshot below shows that an E-7 with 12 years of service, and three dependents (wife and two kids) receives $389.00 each pay period, or $778.00 per month in COLA. COLA is adjusted once a year, so it may change during your assignment.

Basic Allowance for Housing (BAH) vs Overseas Housing Allowance (OHA)

While in Hawaii you receive standard BAH rates for a US zip code (Pearl Harbor is 96860). Though sometimes considered an “overseas” move, you do not receive OHA while stationed in Hawaii.

The chart on the next page shows BAH rates for the island of O’ahu, where almost all Hawaiian military bases are located (Pearl Harbor, Hickam AFB, Schofield, MCB Kaneohe, Fort Shafter). BAH in Hawaii has gone up significantly over the last five years. An E-7 with dependents received $2637 in 2012, but will receive $3075 in 2014.

If you stay on base, privatized housing will take your entire BAH as payment for base housing. If you are dual military, they will take dependent rate BAH, and provide a single rate payment for the lower ranking spouse. Of note, if you are promoted while in base housing, they will take the higher BAH for the next rank as well.

As a side note, base housing in Hawaii is a good deal money-wise. Utility costs are very high in Hawaii. Receiving free electricity and water on base saves you a lot of money.

Summary

I hope you found this guide useful. Scroll below to see the BAH and TLA charts.

Please contact me if you see any errors or this document, or have a different experience with one of the benefits. Email with any questions on moving to Hawaii. I’m happy to help.

Appendix 1 Oahu, Hawaii BAH Rate Chart

Hawaii BAH Rates as of January 2016 |

||

| Rank | With Dependents | Without Dependents |

| E-1 | $2466.00 | $1980.00 |

| E-2 | $2466.00 | $1980.00 |

| E-3 | $2466.00 | $1980.00 |

| E-4 | $2466.00 | $1980.00 |

| E-5 | $2631.00 | $2196.00 |

| E-6 | $2961.00 | $2328.00 |

| E-7 | $3072.00 | $2478.00 |

| E-8 | $3192.00 | $2697.00 |

| E-9 | $3363.00 | $2799.00 |

| W-1 | $2964.00 | $2406.00 |

| W-2 | $3120.00 | $2694.00 |

| W-3 | $3267.00 | $2808.00 |

| W-4 | $3399.00 | $2988.00 |

| W-5 | $3555.00 | $3099.00 |

| O-1E | $3096.00 | $2631.00 |

| O-2E | $3246.00 | $2775.00 |

| O-3E | $3423.00 | $2961.00 |

| O-1 | $2667.00 | $2304.00 |

| O-2 | $2952.00 | $2574.00 |

| O-3 | $3261.00 | $2841.00 |

| O-4 | $3615.00 | $3084.00 |

| O-5 | $3864.00 | $3153.00 |

| O-6 | $3903.00 | $3267.00 |

| O-7 | $3942.00 | $3333.00 |

Current rates at: http://www.defensetravel.dod.mil/site/bahCalc.cfm

Appendix 2: TLA Pay Chart

TLA Pay Chart as of 1 Jan 2017

| PERCENT | NUMBER OF FAMILY MEMBERS | MAX RATE | MEALS | LODGING |

| 65% | MEMBER OR 1 DEPENDENT | $195.00 | $79.95 | $115.05 |

| 100% | MEMBER AND 1 DEPENDENT | $300.00 | $123.00 | $177.00 |

| 125% | MEMBER AND 1 DEPENDENT WITH 1 CHILD UNDER 12 YRS | $375.00 | $153.75 | $221.25 |

| 135% | MEMBER AND 1 DEPENDENT WITH 1 CHILD OVER 12 YRS | $405.00 | $166.05 | $238.95 |

| 150% | MEMBER AND 1 DEPENDENT WITH 2 CHILDREN UNDER 12 YRS | $450.00 | $184.50 | $265.50 |

| 160% | MEMBER AND 1 DEPENDENT WITH 1 CHILD UNDER 12 AND 1 OVER 12 YRS | $480.00 | $196.80 | $283.20 |

| 170% | MEMBER AND 1 DEPENDENTWITH 2 CHILDREN OVER 12 YRS | $510.00 | $209.10 | $300.90 |

| 175% | MEMBER AND 1 DEPENDENT WITH 3 CHILDREN UNDER 12 YRS | $525.00 | $215.25 | $309.75 |

| 185% | MEMBER AND 1 DEPENDENT WITH 2 CHILDREN UNDER 12 AND 1 CHILD OVER 12 YRS | $555.00 | $227.55 | $327.45 |

| 195% | MEMBER AND 1 DEPENDENT WITH 1 CHILD UNDER 12 AND 2 CHILDREN OVER 12 YRS | $585.00 | $239.85 | $345.15 |

| 200% | MEMBER AND 1 DEPENDENT WITH 4 CHILDREN UNDER 12 YRS | $600.00 | $246.00 | $354.00 |

| 205% | MEMBER AND 1 DEPENDENT WITH 3 CHILDREN OVER 12 YRS | $615.00 | $252.15 | $362.85 |

| 210% | MEMBER AND 1 DEPENDENT WITH 3 CHILDREN UNDER 12 AND 1 CHILD OVER 12 YRS | $630.00 | $258.30 | $371.70 |

| 220% | MEMBER AND 2 CHILDREN UNDER 12 YRS AND 2 CHILDREN OVER 12 YRS | $660.00 | $270.60 | $389.40 |

Have a question? Ask the Facebook Group.